OPINION: Mr President, please be considerate and fair as you move to levy new taxes

Even though Ruto thinks that he is doing the right thing, while not making a popular decision, there is a need for his government to reconsider some of these decisions.

Last Friday, I was at the barbershop getting my hair cut. For men, the barbershop is where they speak about everything. From family issues to politics and everything else.

When we got to the political subject of the day, the entire room of about eight people (all men) by default chose the discussion of the day to be on the Finance Bill 2024. The bill proposes an annual 2.5 per cent tax on vehicle owners, 16 per cent VAT on bread, and a rise in excise duty on M-Pesa and bank transfers.

More To Read

- KRA extends tax filing deadline by one day after taxpayers faced technical hitches

- State slashes digital transfer tax to 1.5 per cent to boost tech sector

- Treasury targets foreign firms in public tenders with fresh tax proposal

- Kenya lost over Sh500 billion to tax waivers and corruption- report

- Cabinet approves Finance Bill, 2025, targets tax loopholes

- Bill proposes new tax regulations for freelancers, gig workers

These are only a few of the salient features of the law that I have selected. The administration of President William Ruto has imposed levies and taxes on several measures that have been approved and are currently being carried out despite some opposition.

I assume that this entire period is a result of middle-class earners being negatively impacted by taxes. I am referring to those who are employed in this situation. But the National Treasury's planned Finance Bill suddenly appears to have touched a live wire by targeting a product like bread, which is why it's being discussed in barbershops and other public places.

Now, back to our story at the barbershop, one of us who was in line waiting for his chance to get his hair cut burst into anger and said, “I voted for this government, but now wanaweka ushuru hadi kwa mkate (they now want to tax bread),” said the man.

This led to a heated discussion that ended in an agreement between the men that the government was “overdoing it” in introducing new taxes.

The man they voted for, Ruto, thinks differently about taxes. During the Labour Day celebrations, the President said that this country will be built by our taxes and not debt.

While I partly agree with the President, I think it is important that he remember that he came to power by votes from those he called “fellow hustlers” who are currently feeling “betrayed” by their Chief Hustler.

Even though Ruto thinks that he is doing the right thing, while not making a popular decision, there is a need for his government to reconsider some of these decisions.

When governments introduce new taxes, it's not just a matter of crunching numbers; it's about understanding the real-life impact on citizens and the economy as a whole.

Taxation is the lifeblood of any government, providing the necessary resources to build infrastructure, support social programmes, and ensure the well-being of its citizens.

However, how taxes are levied and the burden they place on individuals and businesses must be carefully calibrated to avoid undue hardship and foster economic prosperity.

The recent outcry from citizens is not merely a cacophony of complaints but a poignant plea for fairness and transparency in the tax system.

Many feel they are already stretched thin, struggling to make ends meet in an economy fraught with uncertainties. For them, any additional tax burden feels like a heavy yoke on already weary shoulders.

Furthermore, the lack of meaningful consultation with the public exacerbates the sense of alienation and distrust towards the government. Decision-makers must recognise that governance is a collaborative effort, not a unilateral decree.

Citizens are the backbone of any nation, and their concerns shouldn't be brushed aside lightly. Therefore, it is imperative for governments to carefully reconsider theair decisions before announcing new taxes.

In light of these considerations, it is incumbent upon the government to take a step back and reassess its taxation strategy.

This is not a sign of weakness but of wisdom and responsiveness to the needs of the people. Rather than bulldozing ahead with unpopular measures, our leaders should demonstrate humility and a willingness to listen.

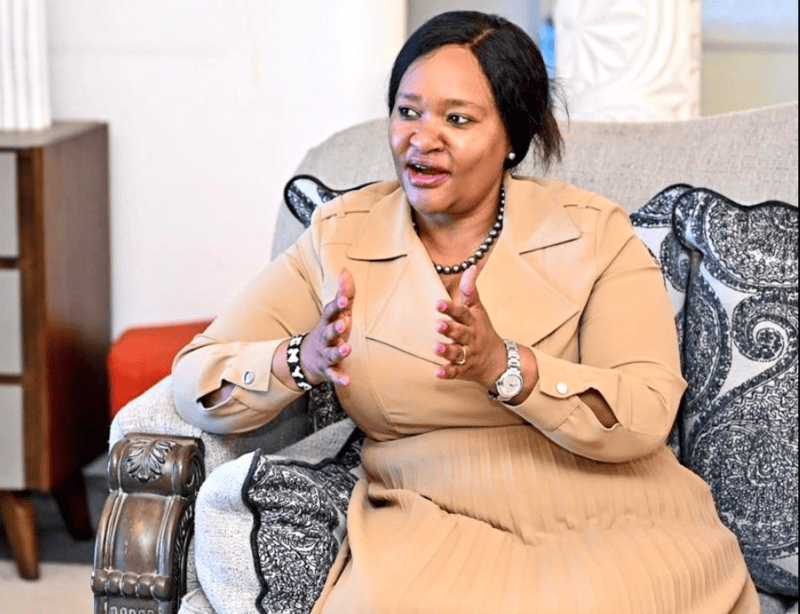

The writer is a Mombasa-based communication and marketing expert.

Top Stories Today